A salary slip, also known as a payslip or paystub, is an official document issued by an employer, finance, or payroll officials, to an employee for providing details of a salary breakdown. It contains complete information on the employee’s earnings and deductions for a particular month. The employer is obliged to issue a payslip to all of the employees, either in a printed or online form.

Verification of employment…

A salary slip not only verifies the employee’s employment but also documents the earnings of the employee, thus helping in record-keeping for the employee’s personal file.

A salary slip could be helpful in many ways. Below are mentioned few points which refer to the importance of a salary slip:

- Proof of Employment – while applying for an International scholarship program, or international travel, the visa agencies require a bank statement of the applicant to track the account balance. Thus, during the visa application process, a salary slip provides an account of the income source of the applicant, by serving as proof of employment

- Validation for Financial Institution – when an applicant applies for a loan, credit card, or opening of a bank account, the banks require the applicant to provide a source of income that could serve as proof of the borrower’s ability to return the debt.

- Calculation of Income Tax – a salary slip provides complete details of earnings and deductions (which could include provident fund, federal tax, or any other deductions). Thus, it helps in calculating the income tax to be paid by the employee or to be claimed by means of an income tax refund.

- Reference document for Existing/Potential Employer – while processing an application process of a potential employer, the employer may require the applicant to submit a copy of the existing or previous contract, or a salary slip. The salary slip helps in negotiating the salary offer. Also, the salary slip helps an employee to ask for a salary raise from the existing employer, based on performance and market competitive salary.

Thus, for an employee, it is important to have a salary slip as it can help him/her for any of the above-mentioned reasons. The employee should maintain a record of all of the provided salary slips, to use them later when the need arises.

Providing a salary slip is mandatory…

It is a right of an employee to be provided with a salary slip, and employers, in many countries, are legally bound by the law for issuing a salary slip to all of the employees, as evident from the Fair Work Act 2009, Section 536, which states an obligation on employers to issue payslips to the workers or employees.

A similar law exists in the United Kingdom as the Payment of Wages Act 1991, which grants a right of attaining or receiving payslips to all employees and workers, likewise the right to payslip in India is addressed under Minimum Wages Rules.

Format of the slip…

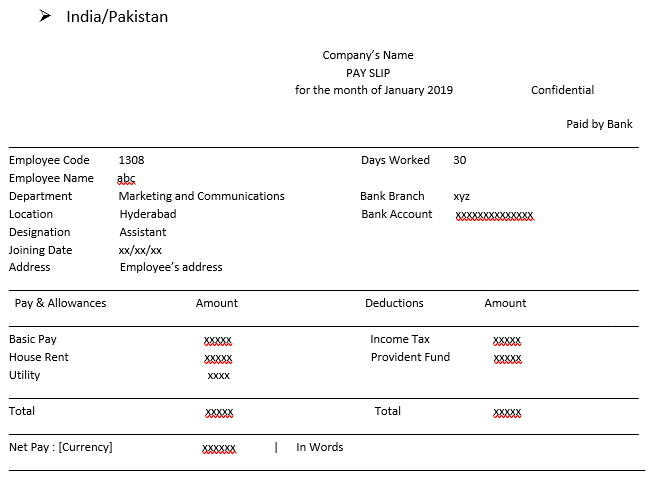

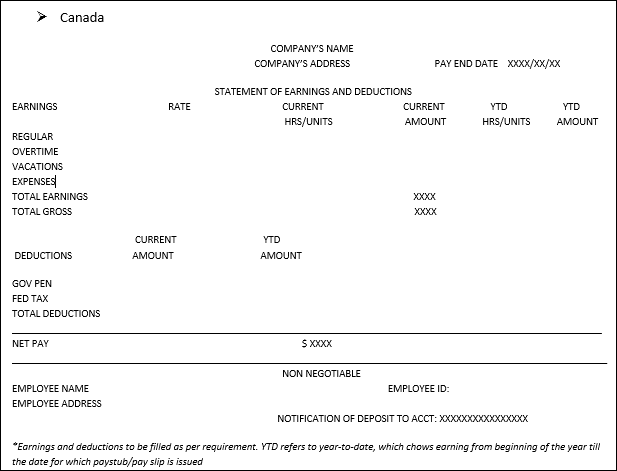

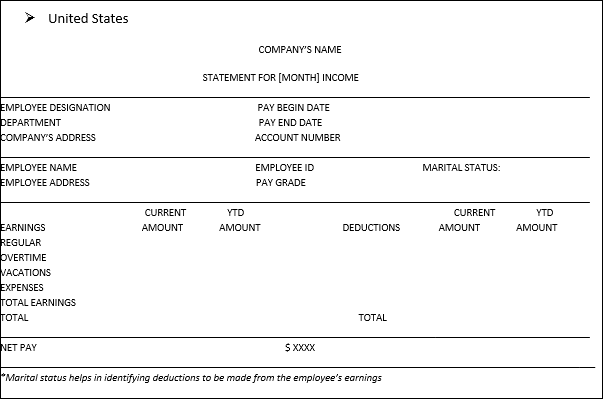

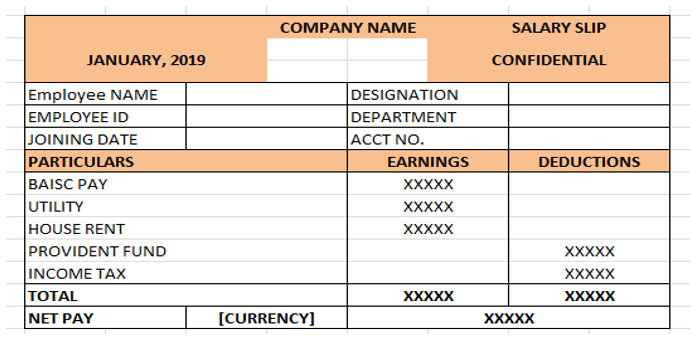

The format and components of a salary slip can vary for different countries. But the basic important components of the slip remain the same, which include:

- Company’s Name

- Header: which includes the title (salary slip), and month (for which the salary slip is being issued)

- Employee Name

- Employee Designation

- Address

- Income

- Basic Pay – the income which an employee without the addition of any allowance

- House Rent – it is added to an employee’s earnings if he /she lives in a rented home

- Medical Allowance – it is an allowance given to an employee, to make up for the medical expenses

- Bonus – added to income, in case of exceptional performance

- Deductions

- Provident Fund – it serves as a serving, and the amount which is deducted from an employee’s income is returned as twice by the employer when the employee’s contract ends

- Employee Old-age Benefit Insurance – deducted from the employee’s income, which can be later claimed by the employee from a relevant institute that manages employees’ pensions

- Taxes – income tax, professional taxes, or any other tax may get deducted from the employee’s income as per the country’s or state’s law

- Net Pay – the total payment that an employee receives after deductions have been made

(Any other allowance or deductions may become part of the salary slip as per the requirement or rules of the company or state)

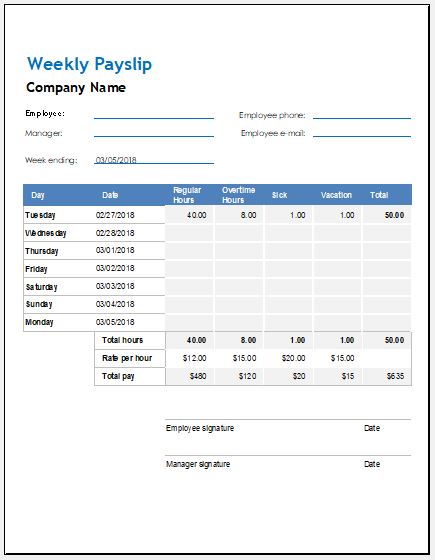

The salary slip may also contain the Employee’s ID, No. of working hours/days, and details of the Bank’s branch and account. Below is given an overview of different formats of salary slips for different countries:

India/Pakistan

Canada

United States

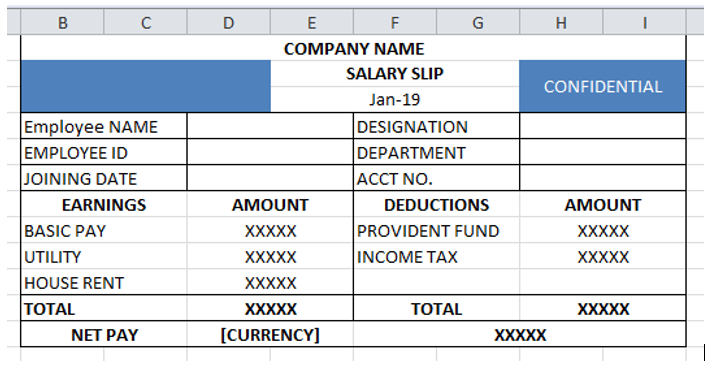

There are different tools that can be used to generate a salary slip of an employee other than MS Word. Though multiple online software is available to ease the process, Microsoft Excel is readily available and is convenient to use. However, one requires practice for the effective utilization of MS Excel. Below are formats that can be used for Excel payslips, and can be customized as per requirements:

The pay slip in MS Excel can be generated or created by two means:

Using Existing Template

MS Excel provides the user with an inventory of templates that can be used by the finance department to create salary slips for the employee. Below are mentioned few steps which are used to create a template on MS Excel:

- Download MS Excel if you do not have one, already

- Open the file of MS Excel

- Click the File tab, and you would see an option for New

- After clicking New, a box would appear displaying available templates It also consists of Office Templates. While you explore those templates, you would see a folder for Payroll

- Open the Payroll folder. It would now display various templates that could be used. Select as per your requirement and download

- Once you have downloaded the template, it would open on its own and you can edit the data as per the requirement

- These templates are preferred over manual ones because they are embedded with formulas and the user does not need to apply the formula for calculation. You just have to enter the employee’s code, and name, and change numerical figures as per the employee’s earnings and deductions, and Excel would apply the formula on its own, thus calculating the employee’s net income for a particular month.

- The sheet can then be saved and printed later when required.

Creating Template Manually

In order to create a template manually, one needs to have MS Excel. Once the file is there, open the excel sheet and then follow the below-mentioned steps to create the simplest template:

- Click the File tab, and you would see an option for New

- After clicking New, a box would appear displaying available templates. Click on Blank Workbook

- Each block of the workbook is known as a cell. Cells can be merged horizontally, and vertically. The font, color, text alignment, and borders of a cell can be changed too from the portion displayed below the file option. That portion is called ribbon

- First enter the top post part which should include Company Name, Salary Slip Month and Employee’s Details, and others as per requirement

- It should then be followed by a middle part, which includes earnings and deductions. Text and numerical figures should not be merged, they should be entered in separate columns. It would help later during calculations

- Once the earnings and deductions have been added, the sum can be calculated for each using formula, which is, =SUM (Number 1, Number 2). In Excel, whenever an equal (=) sign is added, it gives a command that a formula is being applied, SUM means addition. It is followed by the parenthesis “(“, which represents the range that has to be calculated. Number 1 represents the first number that is to be added and all respective cells which are to be added can be selected. Once the complete range of cells has been selected, use the parenthesis close “)”, and enter to apply the formula. This way, calculate earnings and deductions

- For Net pay, minus deductions from earnings, by using the above method but different formula. This time formula for subtraction would be used, which is =MINUS(Number 1, Number 2)

Sample Templates

- Client Information Sheets

- Customer Profile Sheet

- New Customer Information Sheet

- Task Completion Status Sheet

- Open House Sign in Sheet

- Financial Comparison Analysis Sheet

- Monthly Attendance Sheet for Employees

- Product Comparison Sheet

- Tenderer Information sheet

- Equipment Demand Sheet

- Christmas Party Menu Sheet

- Business Format Client Information Sheet