A tax clearance certificate is proof that a particular person or entity has paid all due taxes as of a particular date. A tax clearance certificate is issued to a person after he/she has paid all taxes in full.

Usually, this certificate is important in several situations including a change of job, filing taxes, moving to another state, emigration and to show that a person or organization is law-abiding and tax filer. A tax clearance certificate shows that the person or organization holding it is a good citizen.

Although the document is not necessary for everyone to obtain, it is important. Having a tax clearance certificate adds to the goodwill of individuals, institutions, and organizations. Moreover, obtaining a tax clearance certificate takes time. Therefore, if you are planning to emigrate or make a move to another state, it is better to apply for a tax clearance certificate. Other circumstances in which you might be required to obtain a tax clearance certificate are:

- Applying for a service contract in the government

- To apply for a license or to renew a license

- If you are applying for a grant from the public sector

A tax clearance certificate is issued by the revenue control authority of every country. The Revenue Control Authority is a government organization in charge of collecting tax revenues. The procedure to apply for a tax certificate may be different in different countries. It may take up to two weeks for the tax file to be processed and another 10-12 weeks for the certificate to be issued.

It is important to know that the tax clearance certificate shows only that a taxpayer is tax compliant. The certificate is not indicative of any other claims made by a person or institution nor can it be used to measure the ethical performance of a company.

Finally, a tax clearance certificate is valid for a fixed period. However, even within that time, the validity is subject to tax compliance. Therefore, if a person or organization is found to have violated the tax compliance requirements, this certificate may not be valid.

If you are a contractor inquiring about an applicant, then you must check the validity of the tax clearance certificate submitted by the applicant. This can be done by contacting the revenue division directly.

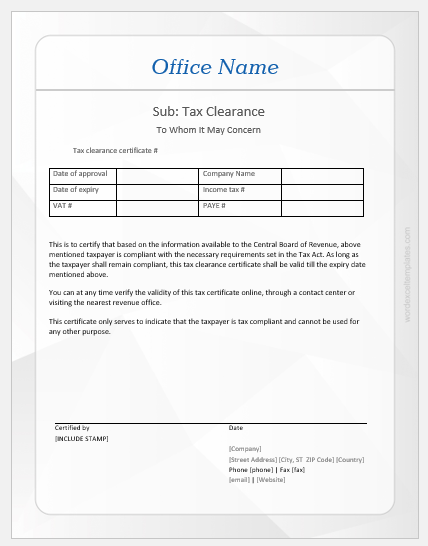

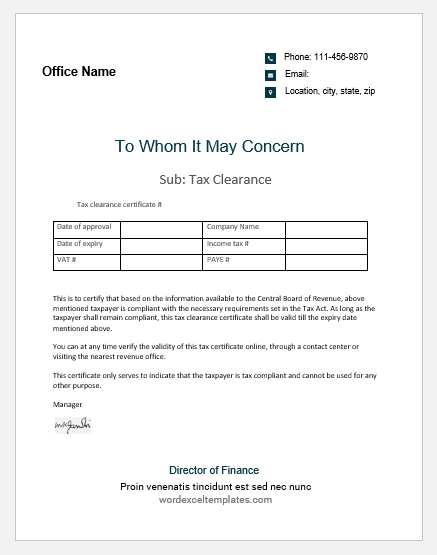

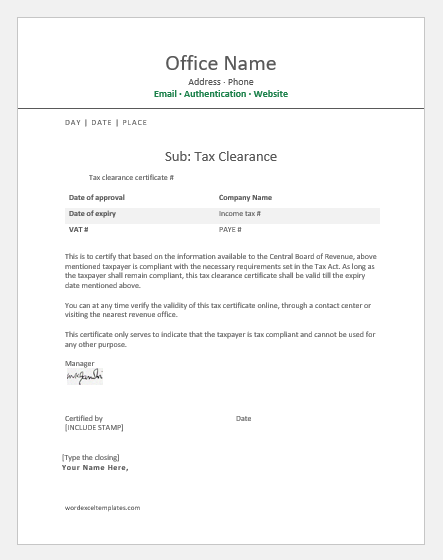

Tax Clearance Certificate

Tax clearance certificate #:

Date of approval:

Date of Expiry:

Company Name:

Income Tax #:

VAT #:

PAYE #:

This is to certify that based on the information available to the Central Board of Revenue, above mentioned taxpayer is compliant with the requirements set in the Tax Act. As long as the taxpayer shall remain compliant, this tax clearance certificate shall be valid till the expiry date mentioned above.

You can at any time verify the validity of this tax certificate online, through a contact center, or by visiting the nearest revenue office.

This certificate only serves to indicate that the taxpayer is tax-compliant and cannot be used for any other purpose.

Preview

MS Word [.docx]

Preview

MS Word [.docx]

Preview

MS Word [.docx]

- Perfect Attendance Certificate for Employees

- Certificate of Appreciation for Best Speaker

- Internship Completion Certificate from Bank

- Employment Certificate Templates

- Probation Completion Certificates

- Internship Completion Certificates for Word

- Employee Salary Certificates for Word

- Work Completion Certificates for Various Jobs

- Bonus Certificate Template

- Salary Certificate Format and Templates

- Experience Certificates

- Employment Certificate Templates

- Certificate of Quality and Conformity

- Certificate of Analysis Template

- Certificate of Conformity