As the name suggests, a promissory note is a written promise or a written agreement, like an IOU, that is drafted at the time of borrowing money from someone. In this note, a borrower makes a promise to pay the money back to the lender at the pre-decided time, at the pre-agreed interest rate, and with the predetermined repayment schedule. The promissory note for a personal loan is written evidence, which is usually used when a lender is lending to a relative or a friend.

When an individual borrows from a bank, it involves many legalities and often takes a lot of time. To avoid those things, sometimes one seeks to borrow a personal loan from a relative or a friend who can easily lend the money. Due to the acquaintance and relationship, people often avoid making legal contracts, for which a promissory note is a substitute and savior.

This is a legal document that can be made without any complications. It states all the significant information that is important for the loan transaction.

Sample Promissory Notes

#1

I (name of the borrower) am writing this note to officially inform you that Mr. XYZ (name of the lender) has given me a loan of amount _____ on date (__/__/__). I abide by the law to pay this loan back over the following terms and conditions:

- The borrower is responsible for paying the amount of the loan in the same currency as it was received by him. The lender will not collect any other currency even if it is equivalent to the loan amount

- Interest on the whole amount of the loan will be ______ which will be effective after a period of 60 days.

- If the lender pays the whole amount of the loan within 60 days, then the loan will not be applicable.

- Payment will be returned in manageable installments depending on the ease of the lender. The following schedule will be followed,

Payment 1: __/__/__

Amount: __________

Payment 2: __/__/__

Amount: __________

- The above-mentioned schedule will continue till the borrower has paid all amounts over the period of 4 years.

- If the borrower is not able to pay the whole loan in 4 years, the rate of interest will be increased, as decided by the lender.

- The following promissory note is devised after the consultations with legal attorneys therefore, it can be used in a court of law.

#2

Borrower name: ___________

Lender name: _____________

Loan amount: _____________

Date of loan: ______________

The promissory note is devised for the above-mentioned parties on the following terms and conditions,

- The promissory note is a legal document therefore, it can be used for official matters.

- The following note is prepared after conducting productive discussions with legal attorneys therefore, it should be effective immediately after the loan is sanctioned.

- Regardless of the personal relation between both parties, the terms and conditions of this document should be followed by both.

- The loan is sanctioned with a fixed interest rate of 10% therefore, payments shall be collected after proper calculation.

- The loan will be paid off within a period of 5 years in easy monthly installments along with the amount of interest with each installment.

- If the borrower is able to pay the whole amount before the due date, he shall be entertained by the lender.

- The loan shall be paid in the same currency as it was received by the borrower.

_________________

Borrower’s signature

Date: __/__/__

_________________

Lender’s signature

Date: __/__/__

#3

I (borrower’s name), am writing this note officially to inform that Mr. ……….. (Lender’s name) lend me total amount of _______ on date (__/__/__) for a period of 10 years. During this period, both parties will strictly behave professionally and will not berate each other.

The agreement between both parties is dependent on following rules,

- The total time period for paying back the total amount is 10 years which will not be extended at any cost.

- Loan will be paid in quarterly installments thus, making 4 installments per year.

- Amount of installments will be,

Installment #1: __/__/__

Amount: _____________

Installment #2: __/__/__

Amount: __________

- A markup of 20% of the whole amount will be paid off either in installments or after installments have been paid.

- If the borrower fails to pay off the half loan after 5 years, interest on the total amount of the loan would increase to 30%.

- In case of prepayment i.e. paying up the loan in the single shot before the due date, the borrower will be entertained by the lender without any issues.

- In the case of failing to pay off the loan, the borrower will be held in contempt and legal actions will be taken against him.

- Within the 10 years of agreement, both parties will not take legal action against each other.

- Both parties will not try to tarnish the image of the other party in the business community.

#4

Amount of loan: ___________

Borrower’s name: __________

Lender’s name: ____________

Date: __/__/__

Agreement between the above-mentioned parties is devised upon the advice from legal consultants and should be followed by both parties. It is based on the following terms,

- The schedule of making payments will be agreed upon by both parties so that it does not burden the borrower.

- Dates and times of making scheduled payments would be communicated beforehand.

- Payments will be made in the same currency as the loan was received.

- A markup interest of 20% of the total amount must be paid by the borrower within the due date.

- Extension of the due date will not be entertained by the lender at any cost.

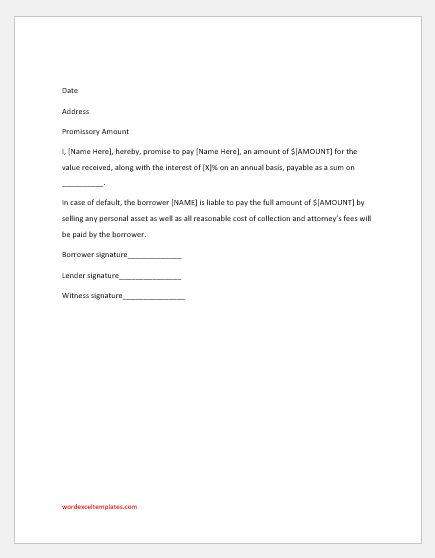

#5

Date

Address

Promissory Amount

I, [Name Here], hereby promise to pay [Name Here] an amount of [AMOUNT] for the value received, along with the interest of [X]% on an annual basis, payable as a sum on __________.

In case of default, the borrower [NAME] is liable to pay the full amount of [AMOUNT] by selling any personal asset, as well as all reasonable costs of collection and attorney’s fees.

Borrower signature_____________

Lender signature_______________

Witness signature_______________

File: Word (.docx) 2007+ and iPad

Size: 18 KB

How to draft a promissory note?

When the promissory note is being drafted by incorporating all the relevant details, it can be prepared by the concerned parties from scratch. Otherwise, they can use a ready-made template, available online or in programs such as Microsoft Word, and customize it as per their requirements and details.

The details and conditions associated with a personal loan, as well as the demands of the borrower, are the factors that determine the choice of the template and the information that needs to be included.

A promissory note can be very brief or quite comprehensive in nature, with a separate repayment schedule attached. However, the general details included in all the promissory notes are:

- Date of the note or date of lending

- Amount lent.

- Details of the borrower.

- Details of the lender.

- The date for the return of the money

- Interest rate.

- Repayment schedule.

- Default conditions and repayment

- Signatures of the borrower, lender, and witness

Although all the conditions are mentioned in the note and are duly signed, the note does not guarantee any repayment. The chances of default cannot be minimized with a promissory note. Nevertheless, this note is an essential document while lending or borrowing a personal loan, as it limits any misunderstandings and ambiguities and can be used as lawful evidence in court in case of default or any other reason.

- First Warning Letter for Negligence of Duty

- Ramadan Schedule Notification for Staff

- One Day Absent Note to Boss

- Request Letter to Staff for Voluntary Deduction from Salary

- Holiday Closing Messages

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR