Every business engages in buying and selling. As a result, they are constantly receiving bills or sending bills. Sometimes these bills may need adjustment which is done through memos.

What is a debit memo?

A debit memo is a document that is used to adjust accounting records particularly when a business sends back goods with a complaint to the supplier. The memo is sent to the seller so that the seller then reduces the amount payable on the invoice. This document is commonly used to adjust accounts and is an official way to reduce outstanding accounts between two entities.

It is considered an official document and is added in the accounting records so that every change in balance is officially recorded. This could be done verbally as well, however, verbal communication could be forgotten, or manipulated and would have no proof thus giving way to illegal activities, accounts dressing and fraud.

Having a debit memo in the records ensures no unreported accounts arise at the time of the audit.

A debit memo may also be used to reduce the balance of a bank’s customer. This reduction in the customer’s account may be due to several reasons including:

- Transfer of funds from one bank account to another bank

- Interest charged by the bank

- A repayment of the loan

- Annual fees charged by the bank

- Any other fee that may have been charged (such as for printing cheque books or other services)

Debit memo in accounts payable

Another use of debit memo is in adjusting accounts payable. When the goods are sent back to the supplier because they were faulty or damaged, a debit memo is also sent to the supplier to adjust the amount on the invoice. Thus, the accounts payable balance is reduced through such a debit memo.

Difference between a debit memo and an invoice

A debit memo is different from an invoice. An invoice is a receipt sent by the seller to the buyer when the buyer makes a purchase. An invoice is a document showing the total amount payable by the buyer. When the buyer receives the goods, they may be checked for damage or working condition.

If the buyer has any complaints regarding the goods, they will send back the damaged goods along with a debit memo so that the supplier can adjust the invoice. Debit memos must include the reason for the memo, along with the date and amount for which accounts payable must be adjusted.

Debit memo and a credit memo

Usually, a debit memo is sent by the buyer, when they are over-billed or there is a deduction from the buyer’s account. Similarly, a credit memo is sent to the buyer when they are under billed.

A credit memo is sent to the buyer if there has been a mistake in the calculation of the invoice (invoice amount exceeds actual amount), or if the seller forgot to add any discounts applicable. Similarly, banks send credit memos to customers when the customers have earned interest on their deposits. The amounts on the debit and credit memos must be adjusted in the accounts and maintained in filed records.

We have many debit memo templates available for free download on our webpage. You can simply download them, add your information and print it out or send electronically.

Preview and download options

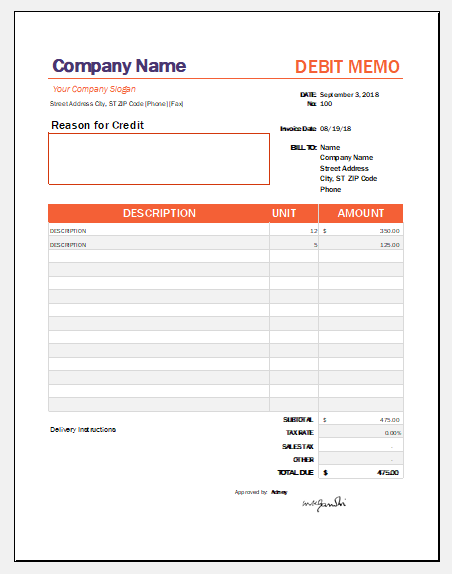

Debit Memo Template -1

File: Excel (.xls) 2003+ and iPad

Size 18 Kb | Download

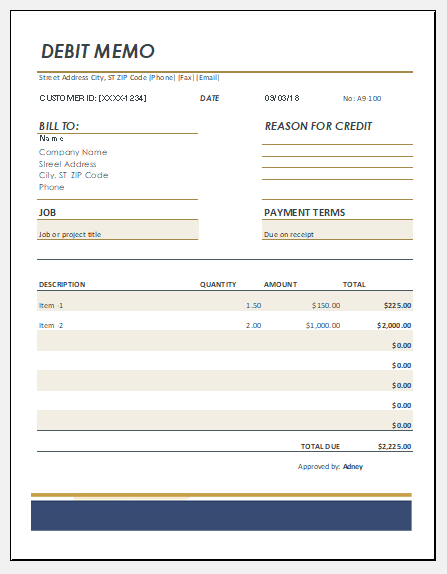

Debit Memo Template -2

File: Excel (.xls) 2003+ and iPad

Size 20 Kb | Download

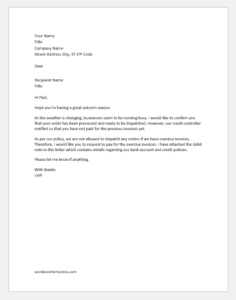

Debit Note Letter to supplier

Hope you’re having a great autumn season.

As the weather is changing, businesses seem to be running busy. I would like to confirm you that your order has been processed and ready to be dispatched. However, our credit controller notified us that you have not paid for the previous invoices yet.

As per our policy, we are not allowed to dispatch any orders if we have overdue invoices. Therefore, I would like you to request to pay for the overdue invoices. I have attached the debit note in this letter which contains details regarding our bank account and credit policies.

Please let me know if anything.

With thanks

Lysh

Debit Note Covering Letter

Hope you’re doing great.

Yesterday, we received your email. My assistant also notified me that we have been receiving calls from your company for chasing the overdue payment. I have been hunting for the paperwork to confirm this overdue invoice. I was waiting to get a confirmation from our warehouse supervisor who has confirmed that we never received these goods.

We had requested to raise a return against these goods, but we never heard back with a return form. These calls and emails are just causing frustration for us. It would be great if you could issue us a credit note and write off this overdue invoice for us.

With thanks

William